Advance Restructuring For Your Institution

last updated on Monday, September 29, 2025 in Advances

Advance Restructuring

If your institution has outstanding Federal Home Loan Bank of Des Moines Advances and would like to extend your duration, FHLB Des Moines offers restructuring Advances using the Blend & Extend strategy. Advance rates have come down across the curve over the last couple years, creating the opportunity to lower your interest expense. There are several reasons to consider to Blend & Extend an Advance for your institution. Whether looking to lower the interest rate on your current Advance or need to fill an existing funding gap, restructuring an Advance can help achieve your goals.

How it Works

The process to restructure an Advance is similar to prepaying an existing Advance except there is no prepayment fee once the transaction is completed. The prepayment fee is still calculated as the present value of the remaining cash flows of the existing Advance. There is no additional fee or premium included if you restructure. It should be noted that you will have to pay all outstanding interest due for the existing Advance upon prepayment. Table 1 is a hypothetical restructure scenario.

In Table 1, the prepayment fee for the advance is $6,000, and this fee will be incorporated into the rate of the new Advance. As a reminder, the prepayment fee of an advance is not based on the original term of the Advance, but the remaining term until maturity. The fee will be added to the posted rate of the term of your choosing. Together, this will create a blended rate for your restructured Advance.

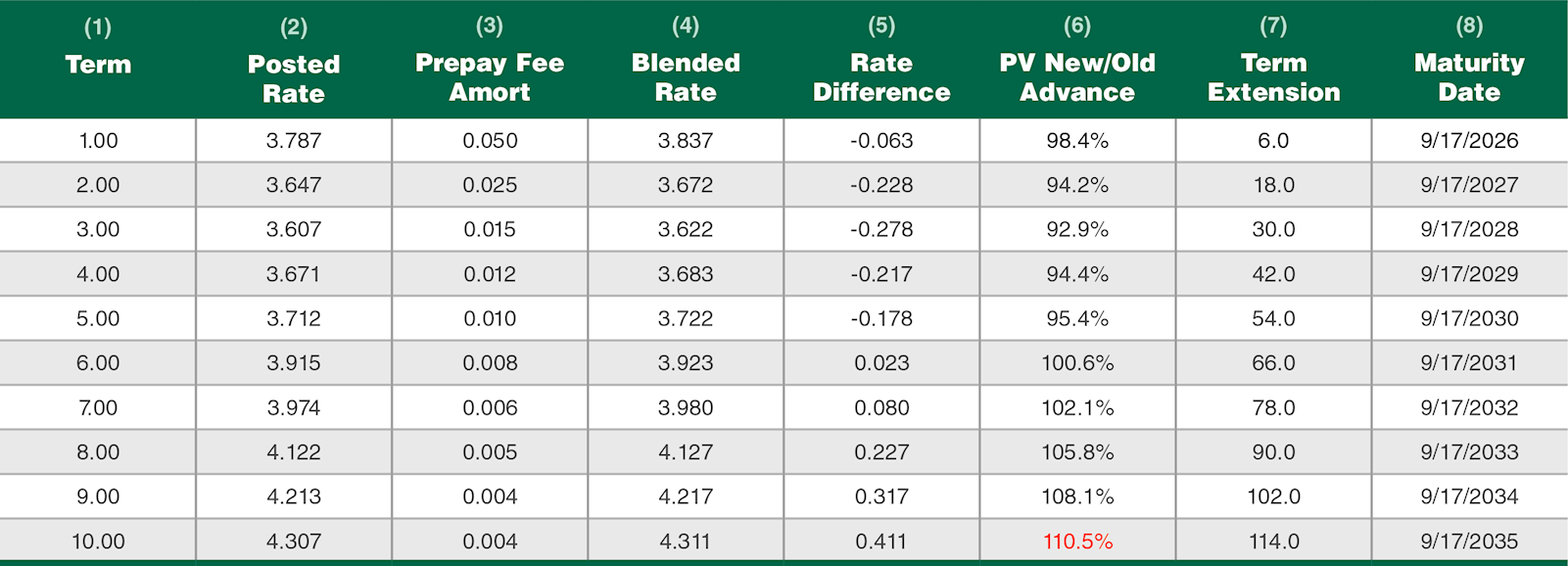

Table 2. The Additional spread over posted rates, by term, if you were to restructure the Advance in Table 1 .

In Table 2, the third column represents the current Advance’s prepayment fee amortized over the life of the new advance. Adding the posted rate for that term in the second column to the amortized prepay fee in the third column gives you the blended rate of the restructured Advance in the fourth column. The fifth column is the difference between the restructured rate and the current Advance (3.900% in this example).

The sixth column indicates what the present value of the new Advance would be in comparison to the existing advance. For the restructure to count as a debt modification, the present value must be within ten percent of the existing advance. Notice that a restructured advance of ten years would not meet the debt modification requirement at 110.5%. This would require the prepayment fee to be booked as a one-time expense. It should be noted that the FHLB Des Moines does not provide accounting advice, and the present value is provided as an indication only. The seventh and eighth columns show how long the existing Advance will be extended and the maturity date of the new Advance.

If you are interested in restructuring one of your institution’s advances, please contact your relationship manager or the FHLB Des Moines Strategies team.

TAGS

- Advance Restructuring

- Advances

- Funding

- Solutions

- Strategies