Time Deposits: Enough Already?

last updated on Monday, August 12, 2024 in Advances

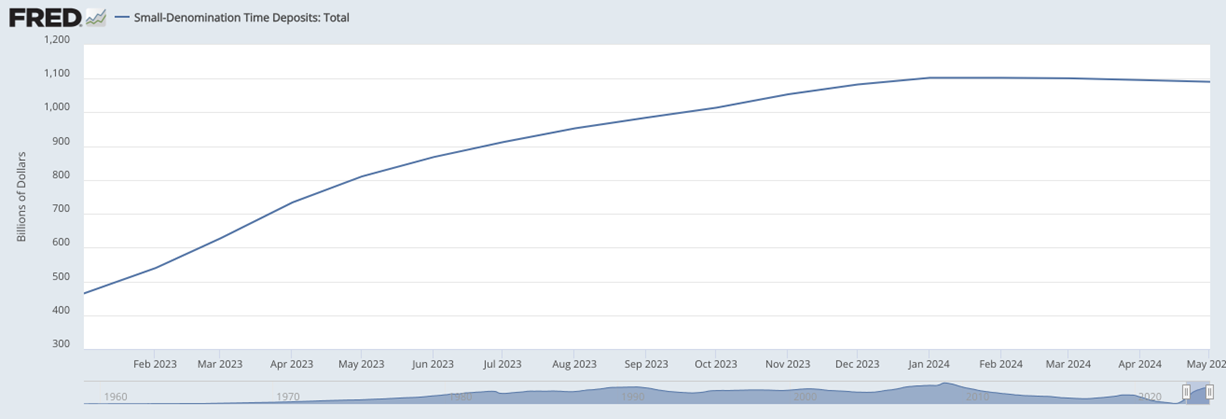

It’s now been over a year since time deposit price wars accelerated, having been exacerbated by: Fed tightening, a liquidity scramble and migration from non-interest interest deposits. As Figure 1 indicates, small denomination deposits of U.S. banks leveled off in January 2024, after having more than doubled over the course of 2023. As term CD maturities are now taking place, the $64 question for the second half of 2024 could very well be: “Having been burned by compressed interest margins over the past year caused by disappointingly uncertain non-to-low interest deposit migration, how should I be funding my balance sheet going forward?”

Here’s a possible near-term scenario: The pace of inflation continues to decline. The Federal Reserve sees its long-sought 2% objective for inflation on the horizon and trims short-term rates. As of this writing, money markets have fully discounted a rate cut by September 2024. Assuming that our marginal cost of funds analytical protocol is in place (assume away!), allowing us to further evaluate the cost of funding a deposit relative to a wholesale benchmark, how can we execute a viable funding strategy that mitigates the hard lessons of duration uncertainty that we faced in 2023? Whereas we used time deposit specials throughout the rising rate cycle, what is the best plan in a falling rate environment?

Figure 1. Small Denomination Time Deposits of U.S. Banks (Federal Reserve Bank of St. Louis)

Extend or Roll-Down the Curve?

Figure 2 depicts current representative term CD rates compared to dividend-discounted FHLB Des Moines term advance levels. We will further assume that interest rates will decline 150 basis points over the next two years. Given the slight inversion in today’s yield curve, would it be advantageous to: a) roll six-month CDs, b) roll 12-month CDs, c) issue a 2-year CD, or fund with 2-year and/or 3-year FHLB Des Moines term advances?

Figure 2. Rates of Term CDs and Term FHLB Des Moines Dividend-Adjusted Advances Assuming a 150 bps Decline over the Next Two Years

|

6-month CD |

12-month CD |

2-year CD |

2-year FHLB Des Moines |

3-year FHLB Des Moines |

| Initial Rate |

5.15% |

5.25% |

4.76% |

3.62% |

3.45% |

| 1st Roll Rate |

4.65% |

4.75% |

|

|

|

| 2nd Roll Rate |

4.15% |

|

|

|

|

| 3rd Roll Rate |

3.65% |

|

|

|

|

| Average Rate |

4.40% |

5.00% |

4.76% |

3.62% |

3.45% |

| Vs. 6-month |

|

|

0.36% |

-0.748% |

-0.95% |

| Vs. 12-month |

|

|

-0.24% |

-1.38% |

-1.65% |

This simple analysis illustrates the benefits of current term advance levels in a prospective declining rate scenario over a hypothetical two-year period without even considering the added marginal cost of rolling deposit rates using balances derived from lower rate, non-rate sensitive depositors that are unnecessarily being paid a higher rate. You might be asking yourself, in retrospect, did the more-than-doubling of term CDs in the financial system and the ensuing rate wars make sense over the past year? FHLB Des Moines advances have long been recognized as a reliable and just-in-time source of liquidity, yet they are also a proven source of competitive funding and balance sheet management.

The CIA Booster

An even more impactful means of term funding could be sourced from the FHLB Des Moines Community Investment Advance (CIA) program. The facility provides a member a lower-cost, term advance for loans that promote qualifying economic development projects. These loan types are easy to declare and identify, either in commercial or residential categories. For example, any loans that you make that would fit SBA parameters generally qualify.

There are several key considerations:

- The CIA program was recently expanded to availability of up to $20 million in cumulative advances per member.

- Advance terms under the program must be one year or more.

- Once the loan is identified and declared, should that asset pre-pay or be sold, the associated advance need not pay down.

- The CIA declaration form is easy to complete. Reach out to your relationship manager for assistance.

- You can take down a CIA advance on an “ex-ante” basis by declaring an intent to originate up to $20 million in CIA advances within one-year of the CIA advance execution.

- CIA advance activity heightens regulatory awareness of the nexus between FHLB advances and member community investment activities.

Importantly, the program offers rates that that have recently been 13-14 basis points below posted fixed-rate advance levels. As such, CIA advances in the Figure 2 illustration would support two-year and three-year dividend discounted advance rates of 3.49% and 3.32%, respectively, an even more favorable spread relative to the simulated term CD program scenarios.

The SOFR-Indexed CIA Option

There is another strategic balance sheet management tool that can be used involving the CIA advance. Members may deploy a variable rate SOFR-indexed Advance with a term of one year or longer. SOFR advances whose maturities are one year or longer may be eligible for the CIA discount. The SOFR advance structure could be useful in funding your indexed- rate assets or in providing a source of term variable-rate funding that could be advantageous in a declining rate environment. As of the date of this writing, the one-year CIA SOFR-indexed Advance rate was 10 basis points over the SOFR index. That was 17 basis points better than the comparable SOFR spread offered without the CIA feature.

Wither the Time Deposit?

Just a few short years ago, pundits had written off the term deposit as a demographic anachronism. However, under 2013’s liquidity strains, many institutions leaned on the product and sustained high marginal costs due to shifts from lower cost and other deposit categories from existing depositors. The speed at which many institutions’ rate risk had shifted away from asset sensitivity was astounding, primarily due to the increasingly uncertain duration of deposits in a rising rate environment. The duration uncertainty of deposits could very well persist in a downward rate environment. Maybe depositors, conditioned with higher rate expectations will be reluctant to accept rate markdowns from your institution. All the more reason to consider duration-certain term advances as a meaningful part of your funding mix. It’s an optimal time to engage with your FHLB Des Moines relationship manager and review blended funding scenarios that include: varying wholesale/retail funding mixes, asset prepayment assumptions, deposit decay, amortization and other variables. The next rate move is a question of “when” rather than “if.” This time don’t make the mistake of being overconfident that declining rates alone, without some duration certainty in your funding structure, will improve your margins Plus, you’ll enjoy the benefits of a double discount via a spread advantage from a 9.50% cash dividend on FHLB Des Moines activity stock, as well as being able to access the Community Investment Advance program.

About the author:

John Biestman, Senior Relationship Manager

John joined the Federal Home Loan Bank System in 2003 and is a highly respected financial strategist, speaker and writer with over 40 years of experience in national and international finance.