Reporting and Pledging Loans in Forbearance Due to Declared Disaster

last updated on Thursday, February 13, 2025 in Member Services

FHLB Des Moines is providing disaster recovery accommodation relief for members with loans originated in impacted areas of Los Angeles County by providing the following collateral accommodations through an an initial period ending May 14, 2025.

Forbearance is a documented, partial or full reduction in loan payments for a temporary period.

Members who have notified FHLB Des Moines (advancecollateral@fhlbdm.com) of their intent to provide borrower disaster relief should report forbearance information on their next BBC or Loan Listing pledge.

BBC Reporting

Members need to verify the inclusion of pledged loans in forbearance on their quarterly Borrowing Base Certificate (BBC) in eAdvantage. This will prompt an expanded BBC form to identify the Unpaid Principal Balance (UPB) for collateral types with loans in forbearance.

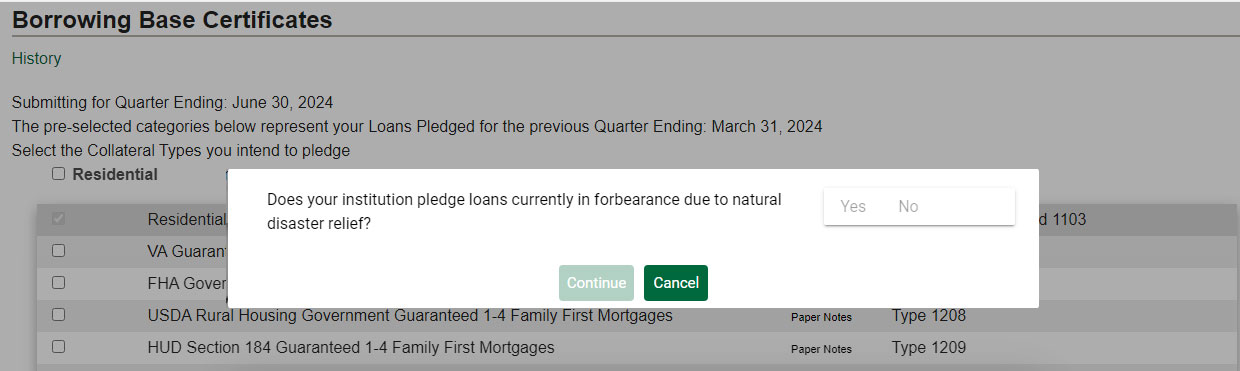

When submitting your quarterly BBC, you will be prompted with the following message:

To continue, it is necessary to select “Yes” or “No”*.

Selecting “Yes” to pledging loans currently in forbearance will create an additional column on your BBC to report the UPB for loans in forbearance. Report your total pledge for the quarter in the left (first) column and the subset of the total that represents the UPB for loans in forbearance in the corresponding column. Amounts entered in Forbearance UPB Pledged cannot be larger than Total Pledged.

Forbearance and BBC reporting of forbearance ends with one of the following events:

- Reinstatement: Deferred amounts are collected at the termination of the forbearance period; scheduled payments under the Note resume. No additional documentation is required.

- Repayment Plan: Repayment of the deferred amounts in addition to the scheduled payments are completed by loan maturity. A Repayment Plan is a loan modification; borrower signature is required.

- Payment Deferral: Deferred amounts are collected at loan maturity. A Payment Deferral is a loan modification; borrower signature is required.

- Loan Modification: A change in terms to the original note; borrower signature is required.

Loan Listing

For loans reported at individual loan level on the General File or the Expanded File formats, forbearance is identified by several fields. The below assists in reporting of forbearance information:

- Modified_Loan: Forbearance is a modification (select Y). The Modified_Loan_Amount and Modified_Loan_Date fields should reflect the UPB and date at forbearance execution.

- Next_Payment_Date: Reflects the next payment due date under the forbearance agreement.

- Paid_Through_Date: Reflects the last date the loan has been paid thru under the original note terms. For example, if the last payment under the original terms was December 1, that is the proper entry for all subsequent periods until the forbearance ends.

- Delinquency_Code: If the loan is paying as agreed per the forbearance agreement you have executed with your borrower; the loan is not delinquent.

Any modification, including a modification described above that ends the forbearance should be reported as a Modified Loan including Modified Amount and Date. Next Payment Date, Paid through Date and Delinquency Code are reported based on terms of the modification.

Loan Forbearance or Loan Modification

- Forbearance Agreement

A Forbearance Agreement is a temporary suspension or reduction in principal and/or interest payments for a period of time, there are no other changes in terms to the original wet-inked promissory note. If no changes to the original wet-inked promissory note take place, no signature is required to witness acknowledgment and consent to the forbearance.

- Modification Agreement

A Modification Agreement is any change in the original terms and conditions of the original promissory note. If changes to the original promissory note take place, signatures from all borrowers are required.

For questions, contact our Collateral Department.

TAGS

- Collateral